What qualifies as R&D?

There are some pretty complex rules about what you can and can't claim for and it's this that puts a lot of companies off getting back what they're owed.

However, with the right help and an eagle's eye for detail, the R&D Tax Relief scheme is the single biggest boost your business can get. Here are a few examples:

- Employee Costs - The people directly working on the project and all associated remuneration. Even if your employees are only partly involved in research and development you can claim for a proportion of their cost.

- Subcontracted R&D Expenditure - If you're an SME, you could claim back a lot of what you're spending on subcontractors for certain R&D activities.

- Software - The cost of the software you need for the project.

- Materials - The actual, physical materials your project uses up.

- Utilities - The water, power and fuels powering your project - although you can't include telecommunications or data costs.

Is my business eligible to claim back R&D Tax Credits?

Eligibility plays a key part in the government backed R&D tax relief scheme. Although the scheme is very inclusive, some basic eligibility criteria must be met before you can claim. These criteria are set out by the UK Government to ensure the integrity of the incentive is maintained and those that wish to claim from it do so with the best intentions. To qualify to claim R&D tax relief, you have to:

- Be a limited company, who is eligible to pay Corporation Tax (although you don’t have to actually be paying it).

- Be a going concern. In other words, you must see yourself continuing to operate for the foreseeable future without a significant risk of going into liquidation anytime soon.

- Have worked on R&D activities within your last two financial tax years, which you may be eligible to claim on (These projects can still be ongoing).

- Be fully or partially self-funding these projects, without any guarantee of what you were working on would be a success.

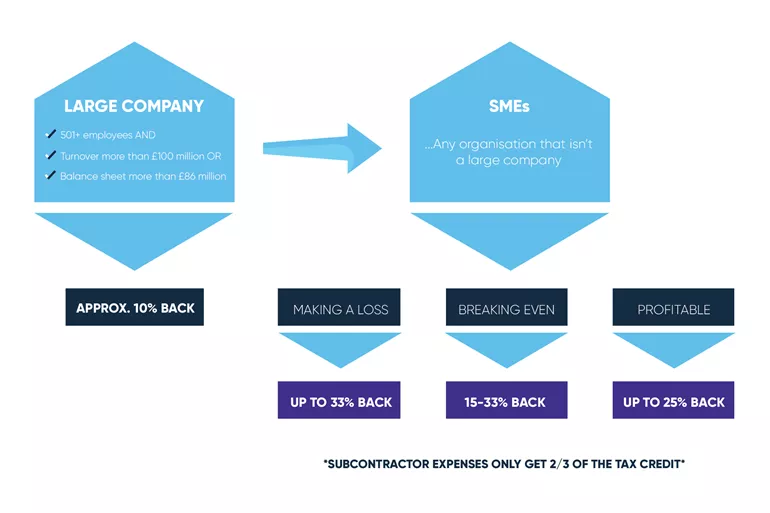

R&D tax credit rates

Examples of qualifying R&D activity

We know it can be hard to understand if you are business qualifies. Having completed a huge number of claims from pretty much every industry out there, we are in a pretty good place to know if what you’re doing qualifies for the scheme. Here are some real-life examples of activities that qualified and how much tax relief they generated.

R&D in the Software Industry:

- Nature of R&D: Innovative teaching aids and Electronic Data Interchange software.

- Overview: Continued developments: custom EDI software for advanced integration with logistics systems; new whiteboards using novel materials; a system of gamified educational resources; an electric laminator extensively adapted for the education market.

- Eligible expenditure identified: £734,621

- Tax relief generated: £187,687

R&D in the Architecture Industry:

- Nature of R&D: Specialist design works.

- Overview: The design specialists engaged in a number of innovative projects, including challenging builds on restrictive heritage sites; unique projects, such as a rotating home, undertaken for Channel 4, and a fully-equipped office space contained within a Nissan van.

- Eligible expenditure identified: £84,396

- Tax relief generated: £12,783

R&D in the Construction industry:

- Nature of R&D: Semi-off site construction systems

- Overview: A number of R&D projects were undertaken, with common goal of adapting a European masonry frame system for use on UK construction sites, overcoming challenges around compliance, plant and machinery, and skills shortages.

- Eligible expenditure identified: £182,313

- Tax relief generated: £45,031

Although there is a vast amount of qualifying activity which can be claimed under the R&D scheme, there are some restrictions too. Some areas of activity which do not qualify for the scheme include:

- Marketing & branding costs

- Admin work

- Routine work such as cleaning or non-essential maintenance

- Bookkeeper or payroll time for paying staff who carry out R&D activity

If you're unsure whether your activity qualifies, speak to us and we'll be able to help you understand whether your activity qualifies under the R&D scheme.

RIFT make the whole R&D claim process straightforward and hassle free. With a guiding hand and an expert eye, we will not only help to see if you qualify for R&D, but help you identify and maximise your entitlement too.

These are the steps to making a successful R&D claim:

- Contact us and find out if you qualify for R&D tax credits.

- One of our specialist R&D consultants will then talk through R&D with you and further understand your business to identify all areas of qualifying R&D activity.

- We will then compile a technical R&D report in HMRCs recognised format, which will be sent to you for your approval on completion.

- Your claim is the submitted (or amended) in your company accounts via your accountant to HMRC.

- HMRC review and approve the claim, before paying out your tax credits.

Sectors we've supported

Where's your R&D lab? Where do you solve problems?

R&D can occur in any sector. If you’ve spent time, money or expertise improving or creating a product, service or process for your industry, then you’re likely to qualify. See the sectors we support and have claimed for below.

Our technical teams specialise in hunting down all your qualifying R&D costs and turning them into a serious financial boost for your business.

Get in touch