The RIFT All-in-One Guide to R&D Tax Credit Claims

The world of Research and Development Tax Credits can look a little murky and confusing from the outside. That’s one of the reasons why so many innovative businesses miss out – the other being that they never even realise the opportunities it offers. The R&D Tax Credits system covers a lot more than most people think, so here’s a simple guide to what it means for your business.

R&D Tax Credits? Never heard of them

To put it simply, the R&D Tax Credits scheme is the largest and most rewarding incentive programme of its kind. If your business is spending cash on solving technical problems and answering important questions, you’ve already got a good chance of qualifying.

The scheme is all about making sure your most challenging and cost generating projects pay off – even if they are unsuccessful. When you’re doing R&D, you’re not just solving an immediate problem for your own business. If you’ve struggled with a technical obstacle, there’s a good chance others have done too. R&D tax credits are there to boost business throughout the whole economy. Providing there isn’t a handy ‘how-to-guide’ surrounding ways on how to overcome the technical challenges you’re looking to overcome, the governments R&D scheme is there to make sure your most inventive work is rewarded.

These challenging projects don’t have to produce the results you were hoping for to qualify for the scheme. The important thing is that you’re spending money on attacking the problem. Basically, if you’ve got smart people burning brain cells on your project, then there’s probably some R&D in the air.

What is R&D? Could my business qualify?

The first thing to know about R&D is that it’s not all about lab coats and Bunsen burners. You don’t need to be working in full-on mad scientist territory to be eligible for R&D Tax Credits. Any time you’re putting time and money into pushing the boundaries of what we know and what we can do in a technical field, there’s a good chance there’s some qualifying R&D in there. That includes:

- Finding innovative new uses for existing technology.

- Making your products or processes more efficient or effective.

- Developing, prototyping and testing new products, services or ideas.

- Getting business done in a safer, cleaner or ‘greener’ way.

How much is on offer?

What you can get from R&D Tax Credits depends on a few factors. The first thing to look at is what size of business you’re running. Small or medium-sized enterprises (SMEs), for example, claim under a different set of rules from larger firms or groups. For a basic guideline, you’re an SME if:

- You’ve got fewer than 500 employees.

- Your turnover is under €100 million.

- You’ve got assets of under €86 million.

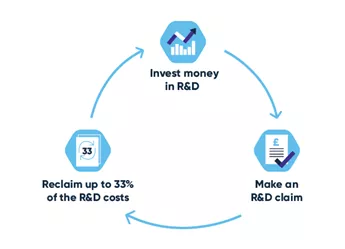

If you qualify for the SME scheme, you can deduct 130% of your qualifying costs from your taxable profits (on top of the 100% already deducted through your P&L). If you’re making a loss, you can claim a tax credit worth up to 33% of your original R&D spend for the period which you are claiming for.

If you’re not an SME, then you’ll be using Research and Development Expenditure Credit (RDEC) for your R&D claims. Under RDEC, you can get a tax credit worth 13% of your qualifying costs.

A couple of wrinkles in the system to be aware of: even SMEs can find themselves claiming under RDEC sometimes too. If you’re subcontracted to a larger firm or part of a group, for instance, you might lose your SME status for the purposes of the scheme. The same thing can apply if you’ve had a grant or subsidy for your R&D work. In any case, you’re always best to speak to an R&D tax consultant to ensure you’re maximising entitlement from the scheme, as well as staying on the right side of HMRC.

What’s involved in an R&D Tax Credits claim?

Making an R&D Tax Credits claim can be a time-consuming process and in industries with a history of under-claiming for R&D (construction, for example), one of the main issues surrounds a lack of understanding of how broad the R&D field is. So much innovative work gets buried in the foundations of construction, because solving complex problems is just part of the day to day.

To get R&D right, the best way to approach it is to put in place ways of capturing the work as it happens. Although this wouldn’t necessarily be expected with your first R&D claim, going forward it would be anticipated by HMRC. Ideally you’ll need records of your potentially qualifying expenditure, along with systems for tracking it whenever it happens. When you’re right at the start of your journey, you won’t necessarily know every problem you’ll have to solve along the way. That means you won’t always know in advance how much R&D you’ll be doing. Spotting and recording your R&D costs when they crop up is a huge part of any successful R&D Tax Credits claim.

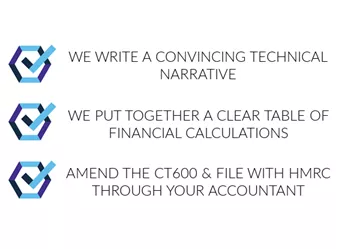

An R&D tax consultant such as RIFT will do all the heavy lifting in both identifying qualifying expenditure and writing a compelling technical narrative in a format native to HMRC. This will give you direction and reassurance before submitting your R&D claim through your accountant, knowing that you’re maximising everything you’re entitled to claim within the boundaries of the scheme.

The Technical Narrative

In addition to the raw numbers needed for an R&D consultant to calculate your tax benefit, a key building block of your claim is what HMRC calls your “technical narrative”. While that sounds pretty vague, what they’re asking for here is proof that the costs in your claim actually qualify for tax relief.

This is where we help you to identify the key details and pull out the narrative for your R&D claim.

In addition, you’ve got to join the dots clearly for HMRC between the research you’ve been doing and the money you’ve spent. It is not enough to simply pull the numbers out of the air, you need to demonstrate how the money spent went into complex, technical work. A weak technical narrative won’t result you in the pay-out your innovation deserves – and can even result in additional scrutiny from HMRC. Once RIFT have compiled qualifying activities and related costs, the information is collated into a technical narrative and financial statement which informs a comprehensive R&D report. Having an R&D consultant who knows the formats HMRC require, speaks their language and are sector specialists when it comes to R&D can really pay dividends at this point in the process, giving you both peace of mind and confidence in the claim which will be submitted to HMRC.

Are there any pitfalls or dangers to watch out for?

In the unlikely event that HMRC raise a query once your claim is submitted, there’s no need to panic, this means they want to understand your project better in terms of the narrative or the cost. However, any enquiry should be treated seriously. It isn’t something to skimp over as HMRC will penalise you for doing so.

At this point the R&D projects and their costs are itemised. You’ve filed your claim correctly, but HMRC have a couple of questions as part of their due diligence checks. This is to make sure that you have applied your projects correctly for R&D tax relief as well as to protect the integrity of the scheme.

If your claim is fundamentally correct and has been completed through an R&D consultant such as RIFT, you’re more than likely to have little to worry about, as this will be a box ticking exercise which your agent will be able to handle comfortably. In the case where you have compiled and submitted your own R&D claim, it is possible to find yourself out of your comfort zone with little to no experience of handling a HMRC query. But fear not, you can still reach out to RIFT who will be able to pick up the baton, review and assess your claim before providing an experienced hand to manage the enquiry.

Depending on the situation, HMRC might raise the stakes with a personal meeting or video appointment to ask a few questions. This doesn’t always mean anything’s gone seriously wrong. It might just be that they want to take a proper look at you before okaying your tax credit. If a mistake in your claim is found, you should get a chance to correct it.

What happens next?

Once your claim is approved, whether fully or partially, you’re generally looking at a wait of 3-6 weeks before it’s all settled. Again, a lot depends on how thorough and accurate you’ve been in your planning and paperwork. Waits of up to 2 months aren’t unusual, but a strong, well supported claim will normally be processed faster.

Can I claim again?

Absolutely – and you definitely should! R&D is an ongoing process, so most businesses with qualifying projects end up claiming yearly. Of course, your costs, innovations and obstacles will change over time, so you can’t just keep submitting the same claim in the same words.

Depending on what you’re working on, your projects might span several years, changing and growing along with your business. On the other hand, agile, fast-moving businesses might find themselves taking on new and exciting projects all the time. Either way, RIFT would be glad to help you embed awareness of R&D right at the heart of your firm when it comes to making the most of your innovation, helping you capture and maximise your return form the scheme year after year.

DIY vs. professional help

Most businesses who are serious about claiming R&D and recognise its value look to use an R&D consultant such as RIFT for their R&D tax relief. It takes real expertise to get the very best out of the scheme.

The R&D rules are full of twists and turns, and a wrong step can lead to your claim falling apart when it’s in the hands of HMRC, if not before. Additionally, those rules are subject to change, leading to missed opportunities or enquires if HMRC see fit to raise one. The right kind of help from the start can make the whole process smoother, less stressful and a lot more rewarding. Tracking down costs, crunching numbers and writing solid technical narratives all take expertise to maximise results.

The RIFT team are on hand to put full momentum behind your R&D claim, helping you understand what costs qualify for R&D tax credits and managing the whole R&D claim process for you. Putting our expertise to use, you can reap the invaluable rewards of the UK R&D scheme while focusing on the day-to-day running of your business.

Our technical teams specialise in hunting down all your qualifying R&D costs and turning them into a serious financial boost for your business.

Get in touch